Solid Start Amid Challenging Environment

DHI Group (DHX) delivered solid Q1 ’24 results, exceeding both consensus and our adjusted EBITDA estimates on an in-line revenue print. Similar to the past few quarters, the top line performance reflected declines at Dice, which were partially offset by continued growth at ClearanceJobs. Bookings also mirrored the same dynamics, but relative to our expectations, Dice was closer to the mark while ClearanceJobs fell short as another potential U.S. government shutdown loomed. As for other key operating metrics, we were pleased to see average annual revenue per customer march higher as new customers embraced recently introduced bundles combining unlimited job postings, a company page and job boosts for hard to fill positions, and we were encouraged by the sequential improvement in revenue renewal rates for both Dice and ClearanceJobs. Below the revenue line, expenses largely tracked our expectations aside from sales and marketing, which came in lower than we anticipated and drove the adjusted EBITDA beat.

Although macroeconomic uncertainty remains a headwind to bookings, several green shoots appear to be emerging. Per management, new tech job postings increased between January and March and have thus far held steady through April. Demand for transactional services, namely candidate sourcing, has also risen and is typically a leading indicator for growth. Interestingly, positions seeking AI-related skills comprised 16% of the company’s job postings in Q1 and have since increased to 17% of postings. We surmise that the surge in demand for a supply-constrained candidate pool is likely to benefit Dice as the company continues to invest in attracting technologists with AI-related skillsets and market accordingly to customers. As for ClearanceJobs, the potential government shutdown in March was averted with a last-minute funding package, paving the way for a reacceleration in bookings growth. Against this backdrop, management expressed confidence in returning to positive company-wide bookings growth later this year. For Q2, guidance calls for revenue to remain at levels akin to Q1, and for FY ’24, management reaffirmed its prior outlook for a low single digit decrease in revenue and an adjusted EBITDA margin of 24%.

With no major surprises in Q1 and no changes to management’s guidance for the year, we made only minor adjustments to our model. Our price target remains $7.00 based on an unchanged FY ’24 EV/Sales multiple of 2.5x. In our view, management’s ability to sustain high adjusted EBITDA margins amid a challenging environment is a testament to the durability and attractiveness of the company’s recurring revenue streams. We believe renewed growth in bookings later this year could serve as a catalyst for shares, resulting in a multiple more befitting of a profitable, subscription-based business.

Exhibit I: Reported Results and Guidance Versus Expectations

Sources: DHI Group; K. Liu & Company LLC; FactSet Estimates

Q1 revenue of $36.0 million (-6.7% Y/Y) was in line with our $35.9 million estimate and the Street’s $36.1 million. Revenues from both Dice and ClearanceJobs were also consistent with our expectations, coming in at $23.2 million (-13.9% Y/Y) and $12.8 million (+9.7% Y/Y), respectively, versus our estimates of $23.1 million and $12.8 million. The revenue trends largely reflect the trajectory of bookings seen over the past several quarters.

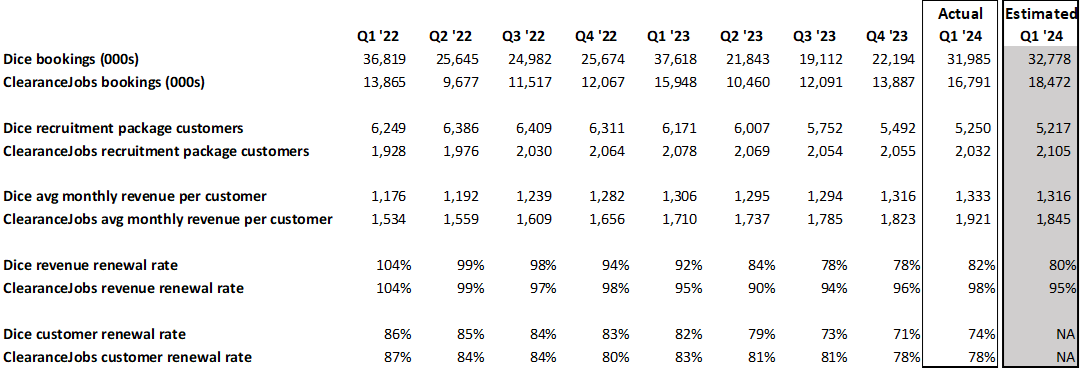

Dice bookings totaled $32.0 million (-15.0% Y/Y), slightly below our $32.8 million projection. Although new business bookings continue to be impacted by the broader macro uncertainty, adoption of new, higher priced bundles drove an increase in average revenue per customer, and the revenue renewal rate also moved higher sequentially. A steady increase in the number of technology job postings over the course of Q1, rising demand for sourcing services and a surge in AI-related hiring all point to improved bookings in 2H ’24.

ClearanceJobs bookings of $16.8 million (+5.3% Y/Y) fell short of our $18.5 million projection. Per management, the looming government shutdown in March prompted some customers to delay purchases. However, the shutdown was ultimately averted with the passage of a bipartisan funding bill. We note that similar dynamics were in play throughout FY ’23, suggesting ClearanceJobs should see a strong rebound in bookings growth over the coming quarters.

Exhibit II: Key Metrics

Sources: DHI Group; K. Liu & Company LLC

Gross margin of 86.5% was slightly above our assumption of 86.1%, while total operating expenses were below our estimate as lower sales and marketing expenses more than offset higher product development expenses. As a result, adjusted EBITDA of $8.6 million (23.8% margin) beat our estimate of $7.6 million and consensus of $7.9 million. EPS of $(0.03) were below our estimate and consensus due to higher income taxes.

Cash at the end of Q1 totaled $3.2 million, while debt outstanding increased from $38.0 million to $41.0 million. During the quarter, DHI Group generated $2.1 million in cash flow from operations and used $4.4 million for capital expenditures. We note that operating cash flow was negatively impacted by a spike in receivables as the implementation of a new billing system created some delays in invoicing. That said, collections should normalize in relatively short order.

Management reaffirmed its prior guidance for FY ’24, which calls for a low single digit revenue decline and an adjusted EBITDA margin of 24%. For Q2, revenue is expected to remain relatively flat on a sequential basis at $36.0 million. Prior to revisions, we were projecting Q2 revenue of $37.0 million, while consensus was at $36.4 million.

Exhibit III: Estimate Revisions

Source: K. Liu & Company LLC

Our revenue estimates decline slightly for this year and next, primarily reflecting the impact of lower bookings in Q1. However, this was offset by a reduction in our sales and marketing expense assumptions, leaving our adjusted EBITDA estimates intact for FY ’24 and FY ‘25. We note that our EPS estimate for this year declines slightly due to higher interest expenses. We continue to expect renewed revenue growth and margin expansion in FY ‘25.

Our report with model and disclosures is available here.

Disclosure(s):

K. Liu & Company LLC (“the firm”) receives or intends to seek compensation from the companies covered in its research reports. The firm has received compensation from DHI Group, Inc. (DHX) in the past 12 months for “Sponsored Research.”

Sponsored Research produced by the firm is paid for by the subject company in the form of an initial retainer and a recurring monthly fee. The analysis and recommendations in our Sponsored Research reports are derived from the same process and methodologies utilized in all of our research reports whether sponsored or not. The subject company does not review any aspect of our Sponsored Research reports prior to publication.