Q1 '24 Earnings Preview

DHI Group, Inc. (DHX) reports Q1 ’24 results on Wednesday, May 8. As noted in our April 12 report, “Recent Data Portends Improving Demand Environment for Dice,” we remain comfortable with our current estimates for Q1 and FY ’24. Recall that the various data points referenced at the time reflected positive sequential trends in new technology job postings from February to March as well as Q/Q growth in job postings for both tech positions and tech recruiters. In contrast, the latest data from the U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) reflects a decline in the number of job openings and quits from February to March, leading us to believe that the broader labor market is now following a similar post-pandemic trajectory to that observed in the demand for technologists. In other words, the market for tech labor corrected sooner and is likely to lead the way out of the soft market conditions at present.

Thus far in the earnings season, Q1 results from several IT staffing companies point to continued stabilization relative to 2H ’23. Commentary from various management teams suggests that demand for IT staffing and services has largely stabilized but remains somewhat uneven from month to month. As such, there appears to be a degree of cautiousness still reflected in near-term expectations with Q2 guidance generally calling for flat to modest sequential growth. Considering the uneven pace of recovery thus far, we expect DHI Group to report Q1 results consistent with Street expectations and maintain its current FY ’24 guidance, which calls for a low single digit decline in revenue and an adjusted EBITDA margin of 24%. Our price target remains $7.00 based on a FY ’24 EV/Sales multiple of 2.5x.

Exhibit I: Our Estimates Versus Consensus

Sources: K. Liu & Company LLC; FactSet Estimates

For Q1, we project revenue of $35.9 million, comprised of $23.1 million from Dice and $12.8 million from ClearanceJobs. We model a 4% decline in bookings as a challenging macro backdrop for Dice is partially offset by favorable market conditions for ClearanceJobs. We suspect our adjusted EBITDA estimate of $7.6 million could prove conservative given the sequential ramp in sales and marketing reflected in our model. With only one quarter completed thus far in the year and no clear trends emerging, we assume management will reaffirm its prior FY ’24 guidance.

Below, we highlight commentary from several IT staffing and services providers as it relates to the current demand environment:

“… from the third quarter into the fourth, and now, the fourth into the first, adjusted for billing days and seasonality, have just really seen a, what I'll say just a steady trend. No real change in client tone or conversations. And here in the first three weeks of the second quarter, more of the same. So it's a little out the norm, if you will. There is typically some seasonality here, where when you move out of the first and into the second, your volumes are ramping up. But we don't see that right now, we just see a steadiness.” -- Theodore Hanson, CEO of ASGN

“Looking forward to Q2, we expect technology consultants on assignment to remain relatively consistent with the levels we ended with in the first quarter and for revenue to increase sequentially in the low single-digits. Year-over-year revenue declines will decelerate to the mid-single digit.” – David Kelly, COO of Kforce

“The market for IT skills in the US remains strong, but it's not as tight as it was and, of course, not even close to as tight as it was immediately post-pandemic. What we're seeing is continued weakness on the enterprise; so large tech companies still being cautious in terms of their overall hiring and coming off a pandemic hiring boom. But convenience demand looks reasonable. It is still weak, but it's stronger than the demand that we see from enterprise tech clients or enterprise clients at large. And just as Jack just mentioned, what we've observed is a stabilization sequentially, which we take as an encouraging first sign. Companies are looking for more specialized skills. And we believe that as the outlook firms up and employers feel better about the economic outlook and see less uncertainty that those trends are going to continue to improve.” – Jonas Prising, CEO of ManpowerGroup

“Well, I would argue the latter, the spring-loaded rebound. And I base that in part on if you look at the number of job openings, which in the US are just under 9 million, while I understand that's less than their peak or it was in the 12-ish range, if you compare to prior staffing industry downturns, that 8 to 9 million is significantly higher than it was at those times. And we view those openings as pent-up demand for future hires, be it contract or perm placement. So we think the level of pent-up demand for hiring as further evidenced by the labor short market we're in, we think that bodes very well, and we think we will come spring loaded when we get through this funk, your word, that we've been experiencing for the last 6, 7 quarters.” – M. Keith Waddell, CEO Robert Half

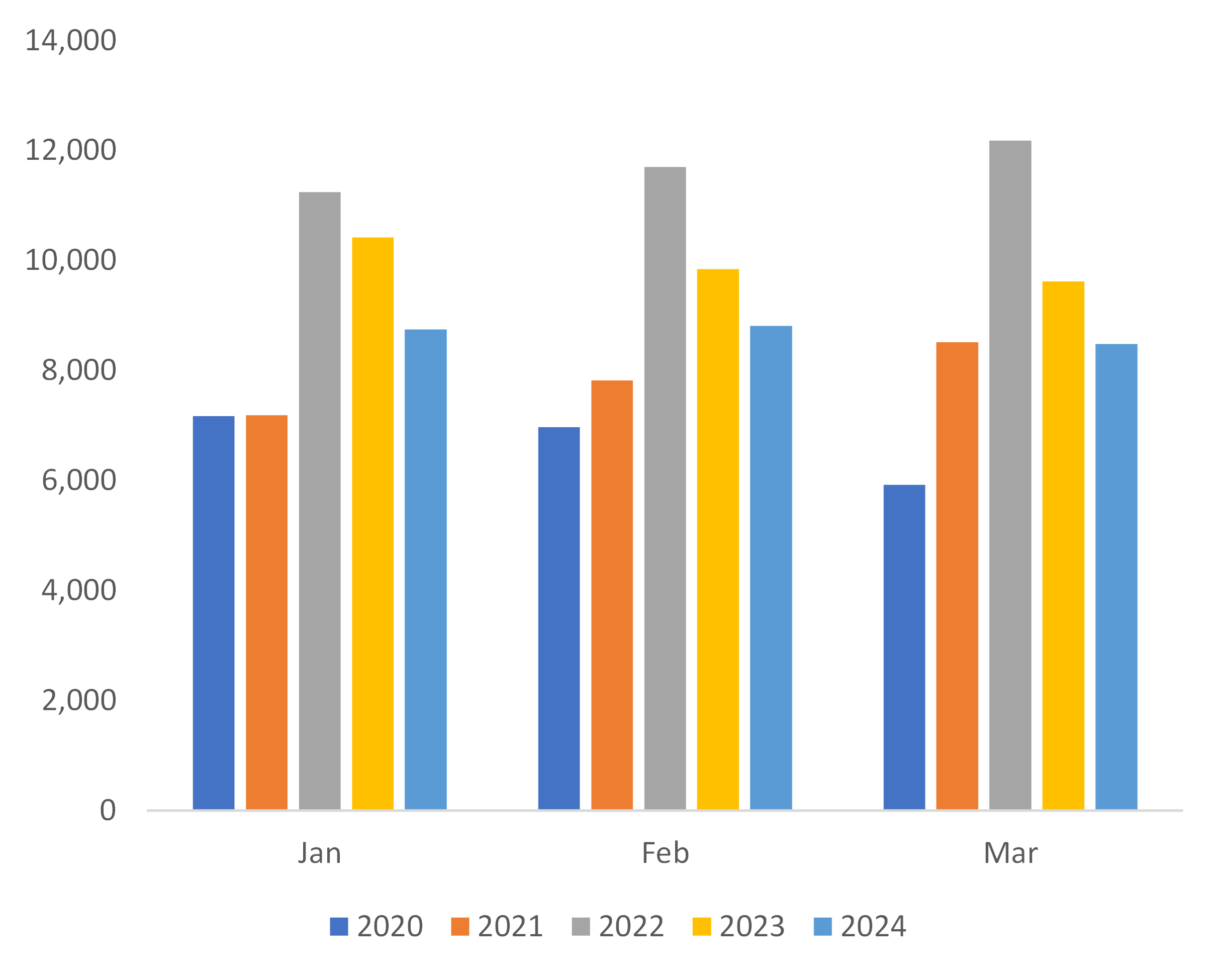

Exhibit II: U.S. Job Openings in Thousands

Source: U.S. Bureau of Labor Statistics Job Openings and Labor Turnover Survey

Exhibit III: U.S. Quits in Thousands

Source: U.S. Bureau of Labor Statistics Job Openings and Labor Turnover Survey

Our model with report and disclosures is available here.

Disclosure(s):

K. Liu & Company LLC (“the firm”) receives or intends to seek compensation from the companies covered in its research reports. The firm has received compensation from DHI Group, Inc. (DHX) in the past 12 months for “Sponsored Research.”

Sponsored Research produced by the firm is paid for by the subject company in the form of an initial retainer and a recurring monthly fee. The analysis and recommendations in our Sponsored Research reports are derived from the same process and methodologies utilized in all of our research reports whether sponsored or not. The subject company does not review any aspect of our Sponsored Research reports prior to publication.