Q3 ’24 Results Fall Short of Expectations

Peraso (PRSO) reported Q3 ‘24 results slightly below Street expectations. Although within management’s guidance, revenues were at the lower end of the range and a hair shy of our estimates and consensus. Relative to our model, memory IC shipments exceeded our estimate but sales of mmWave products fell short. The latter was somewhat surprising to us given the design wins and purchase orders announced over the past several months. Per management, the corresponding inflection point in mmWave revenue is likely in Q1 of next year, so we surmise the timing of production orders and shipments is the culprit for the lack of near-term sales. Gross margin also fell short of our assumption, but this was solely due to an inventory write-down that was not incorporated in our model. Absent that, non-GAAP gross margin would have exceeded our assumption due to the more favorable mix of memory IC sales. Total operating expenses were in line with our model, but with revenue and gross margin light, both adjusted EBITDA and non-GAAP EPS fell short of our estimates and consensus.

Turning to Q4, the midpoint of management’s guidance implies flattish revenue on a sequential basis, falling short of our prior expectations for an uptick. We believe this is due in part to the timing of end-of-life (EOL) memory IC shipments, a portion of which was pulled forward into Q3, and the expected ramp in mmWave sales in Q1 ’25 as opposed to year-end. That said, management’s guidance still reflects strong double-digit growth in the latter half of this year when compared with both the first half of this year and the same period last year.

While we continue to model a material ramp in mmWave sales throughout the coming year, we lower our FY ’25 estimates as we now assume new program wins begin to contribute more meaningfully in Q2 and beyond. While we no longer expect revenue from mmWave products to fully offset the winddown of the memory business next year, we continue to see a path to robust revenue growth in FY ’26. Reflecting the revisions to our model and the dilution associated with Peraso’s recent inducement offer to holders of its Series B warrants, our price target declines from $3.50 to $2.75 based on an unchanged FY ’25 EV/Sales multiple of 1x. At this juncture, we believe Peraso has sufficient cash to operate through 1H ’25. We note that the company has an “At The Market” (ATM) offering in place that could be used to further bolster its liquidity as well as a number of outstanding warrants that could be exercised depending on market conditions.

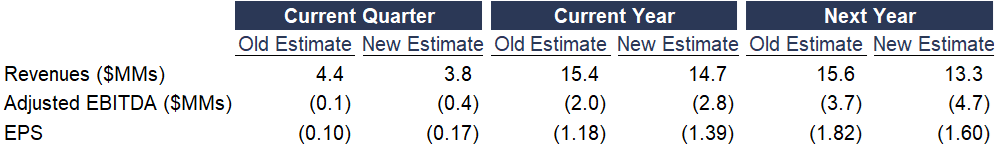

Exhibit I: Reported Results and Guidance Versus Expectations

Sources: Peraso; K. Liu & Company LLC; FactSet Estimates

Q3 net revenue of $3.8 million (-14.3% Y/Y) was in line with management’s guidance for $3.8-$4.2 million but fell short of our estimate and consensus of $4.0 million. Memory IC sales of $3.7 million outpaced our $3.5 million projection, but mmWave sales of $0.1 million missed our $0.4 million estimate. The company ended Q3 with $5.7 million in remaining backlog associated with EOL memory IC orders.

Non-GAAP gross margin of 61.7% was below our 68.6% assumption due to a $0.3 million inventory write-down. If not for that, non-GAAP gross margin would have been 70.0%, reflecting the favorable mix of memory IC revenue in the quarter. Total operating expenses were in line with our estimate. However, adjusted EBITDA and non-GAAP EPS missed our estimates and consensus due to the slight shortfall in revenue and the aforementioned inventory write-down. Cash and investments at quarter-end totaled $1.3 million, and Peraso subsequently raised net proceeds of $2.6 million through an inducement offer with certain holders of its Series B warrants.

Management’s Q4 guidance calls for revenue of $3.6-$4.0 million. Prior to revisions, we were projecting $4.4 million in revenue, while consensus stood at $4.7 million. We think the shortfall relative to our forecast reflects a pull-forward of some memory IC shipments into Q3 and a more limited ramp in mmWave sales exiting the year than we originally assumed.

Exhibit II: Estimate Revisions

Source: K. Liu & Company LLC

We lower our estimates for this year and next to reflect a pushout in our expectations for mmWave sales to ramp. We still expect new programs like the company’s initial award to secure battlefield communications to contribute meaningfully to FY ’25, but the timing of exactly when shipments will commence remains somewhat uncertain. We also introduce our estimates for FY ’26, which reflect robust revenue growth driven entirely by mmWave sales.

Our report with model and disclosures is available here.

Disclosure(s):

K. Liu & Company LLC (“the firm”) receives or intends to seek compensation from the companies covered in its research reports. The firm has received compensation from Peraso Inc. (PRSO) in the past 12 months for “Sponsored Research.”

Sponsored Research produced by the firm is paid for by the subject company in the form of an initial retainer and a recurring monthly fee. The analysis and recommendations in our Sponsored Research reports are derived from the same process and methodologies utilized in all of our research reports whether sponsored or not. The subject company does not review any aspect of our Sponsored Research reports prior to publication.