Q3 '23 Earnings Preview

DHI Group, Inc. (DHX) reports Q3 ’23 results on Wednesday, November 1. We believe end market conditions remained challenging over the past quarter as employers maintained a cautious posture with respect to hiring and investments. Of note, staffing providers that have already reported Q3 results generally saw revenue declines in the mid-teens range, reflecting both challenging comparisons and macro softness in North America. The silver lining thus far, however, has been signs of stabilization in the rate of decline, which combined with easier comparisons ahead should support an improving growth trajectory over the coming quarters. Against this backdrop, we expect nominal revenue growth in Q3 for DHI Group and a bookings decline in the mid to high-single digit range. Given the company’s previously announced cost actions, we think there could be some upside to our adjusted EBITDA estimates but expect an in line print at the very least. As management’s outlook for the year already reflects ongoing headwinds for Dice, we expect guidance for Q4 to be consistent with our estimates and consensus. Our price target remains $9.00, reflecting a FY ’23 EV/Sales multiple of 3x.

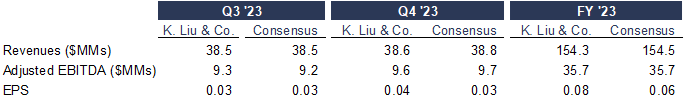

Exhibit I: Our Estimates Versus Consensus

Sources: K. Liu & Company LLC; FactSet Estimates

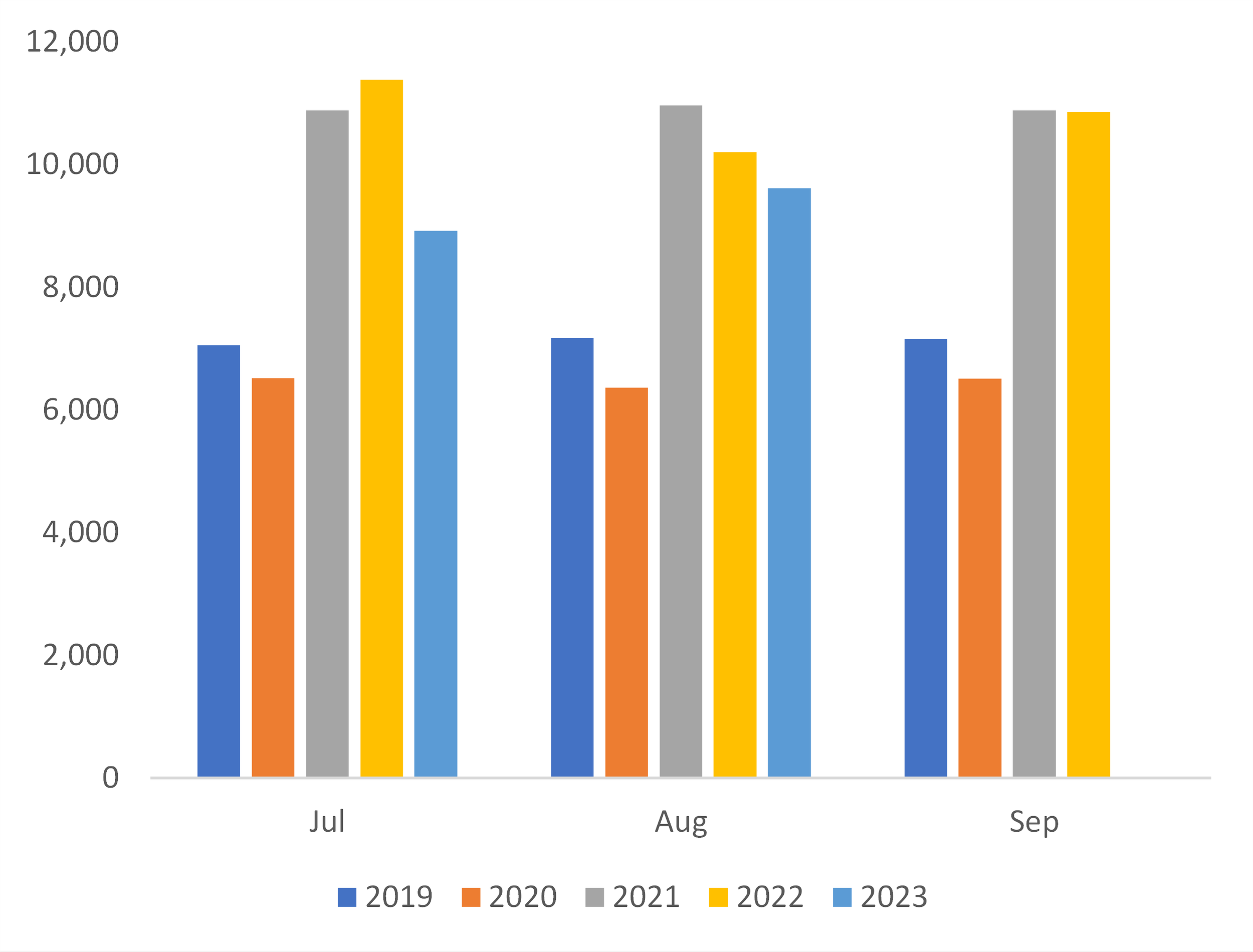

Management’s Q3 guidance reflects flattish revenue growth and an adjusted EBITDA margin of 24%, implying revenue and adjusted EBITDA of $38.5 million and $9.2 million, respectively. Our Q3 estimates are largely in line with management’s guidance and consensus. Worth noting, Microsoft’s LinkedIn revenue increased 8% Y/Y during the September quarter, slightly ahead of internal expectations. However, LinkedIn’s bookings were still down Y/Y, and we expect a similar variance between DHI Group’s revenue growth and bookings performance. Specifically, we project revenue of $38.5 million, comprised of $26.2 million from Dice and $11.9 million from ClearanceJobs. We expect bookings growth to remain under pressure and model a decrease of 6.3% Y/Y. We also estimate adjusted EBITDA of $9.3 million, which we suspect may prove conservative as our expense assumptions only reflect a fraction of the annualized cost savings previously announced. Looking forward, we remain comfortable with our Q4 estimates, which assume modest declines in both revenue and bookings offset by additional operating expense reductions. Longer-term, we remain of the view that the persistent high level of job openings in the U.S. and low unemployment rates among technology professionals will be a boon to DHI Group’s business.

Exhibit II: U.S. Job Openings in Thousands

Source: U.S. Bureau of Labor Statistics Job Openings and Labor Turnover Survey

Exhibit III: U.S. Quits in Thousands

Source: U.S. Bureau of Labor Statistics Job Openings and Labor Turnover Survey

Our report with model and disclosure is available here.

Disclosure(s):

K. Liu & Company LLC (“the firm”) receives or intends to seek compensation from the companies covered in its research reports. The firm has received compensation from DHI Group, Inc. (DHX) in the past 12 months for “Sponsored Research.”

Sponsored Research produced by the firm is paid for by the subject company in the form of an initial retainer and a recurring monthly fee. The analysis and recommendations in our Sponsored Research reports are derived from the same process and methodologies utilized in all of our research reports whether sponsored or not. The subject company does not review any aspect of our Sponsored Research reports prior to publication.