Timing of Orders Drives Q3 ’24 Results Ahead of Expectations

NetScout Systems (NTCT) reported fiscal Q3 ‘24 results well above our estimates and consensus as calendar year-end budget flushes positively impacted the timing of orders. Per management, there was some uncertainty heading into the quarter with respect to whether customers would spend against their 2023 budgets or defer activity until the new year, hence the conservative expectations put forth. Ultimately, the usual seasonal strength in spending materialized to a degree. As anticipated, sales of service assurance solutions remained muted as large service providers continued to pare back capital expenditures. However, enterprise spending on cybersecurity solutions was robust, which in turn drove product and overall gross margins to what we believe are record levels for NetScout. Operating expenses also compared favorably with our estimates, resulting in further upside to both our adjusted EBITDA and non-GAAP EPS estimates.

With only one quarter remaining, management narrowed its FY ’24 revenue guidance to the low end of its prior range and guided non-GAAP EPS towards the higher end. We note that both our estimates and consensus already reflected revenue at the low end of guidance and non-GAAP EPS at the midpoint, so the revised outlook compares favorably with Street expectations heading into the print. Moreover, the pull-forward of orders into Q3 suggests a more normal seasonal cadence than implied in the original outlook, thereby increasing our confidence in management’s ability to achieve its stated targets.

Our revised estimates for FY ’24 reflect the upside in Q3 largely offset by a corresponding reduction in our Q4 expectations given the timing of orders received. For FY ’25, our projections also move nominally higher, and we introduce our FY ’26 projections, which reflect a modest reacceleration in top line growth and renewed earnings growth. Our price target remains $38.00 based on an unchanged FY ’25 EV/EBITDA multiple of approximately 12x. Although near-term visibility remains a bit cloudy due to ongoing budget scrutiny by service providers, the acceleration in cybersecurity sales coupled with secular tailwinds from the expansion of 5G services leave us positive on NetScout’s longer term prospects. We continue to believe shares are attractively valued at current levels.

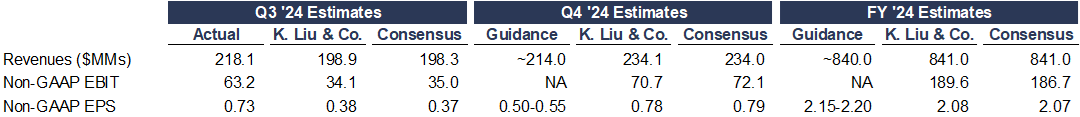

Exhibit I: Quarterly Results and Guidance Versus Expectations

Sources: FactSet Estimates; K. Liu & Company LLC; NetScout Earnings Release

Q3 revenue of $218.1 million (-19.1% Y/Y) was well above our estimate of $198.9 million and consensus of $198.3 million. Both product and service revenue of $95.8 million (-35.9% Y/Y) and $122.2 million (+1.8% Y/Y) exceeded our projections of $85.0 million and $113.9 million, respectively. The upside was largely attributable to the receipt of orders in NetScout’s fiscal Q3 rather than Q4 as customers opted to spend against their remaining 2023 budgets. We note that the prior year period also benefited from budget flushes as well as Radio Frequency Propagation Modeling projects that have since been completed, resulting in a challenging comparison from a growth standpoint. Revenue from service assurance products comprised 68% of revenue and declined 30% Y/Y, reflecting the impact of capital spending constraints by Tier-1 service providers in the U.S. Cybersecurity sales comprised the remaining 32% of sales and increased 20% Y/Y as customers increasingly embraced NetScout’s Adaptive DDoS and Mobile Security offerings. By vertical, service providers accounted for 45% of total revenue in Q3, while enterprise customers comprised the remaining 55% of revenue with the latter benefiting from strength in the financial and government sectors.

Non-GAAP gross margin of 81.3% was above our 77.4% assumption, largely due to product gross margin reaching what we believe is a record high of 86.1% and service gross margin also coming in strong at 78.5%. Total operating expenses were slightly lower than we modeled as R&D expenses were below our projection. As a result, both non-GAAP operating income of $63.2 million (29.0% margin) and adjusted EBITDA of $67.6 million (31.0% margin) far exceeded our estimates of $34.1 million and $38.8 million, respectively. Non-GAAP EPS of $0.73 also beat our estimate of $0.38 and consensus of $0.37.

Cash and investments at quarter-end totaled $330.1 million, while outstanding debt remained unchanged at $100.0 million. In Q3, NetScout generated $13.9 million in cash flow from operations and had $1.2 million in capital expenditures. The company also repurchased approximately 706 thousand shares during the quarter for a total cost of $18.8 million.

With only one quarter remaining, management narrowed its prior FY ’24 guidance ranges. Management’s guidance now calls for revenue of $840.0 million, reflecting the low end of prior guidance for $840.0-$860.0 million, and non-GAAP EPS of $2.15-$2.20, representing the higher end of prior guidance for $2.00-$2.20. We were previously projecting $841.0 million in revenue and $2.08 in non-GAAP EPS for the year, which was generally in line with consensus.

Exhibit II: Estimate Revisions

Source: K. Liu & Company LLC

We lowered our Q4 estimates to account for the pull-forward of revenue into Q3, resulting in a slight uptick to our FY ’24 projections. Our estimates for next year also move nominally higher as we fine-tuned our assumptions. We also introduce our FY ’26 projections, which call for revenue of $873.6 million and non-GAAP EPS of $2.17.

Our report with model and disclosures is available here.

Disclosure(s):

K. Liu & Company LLC (“the firm”) receives or intends to seek compensation from the companies covered in its research reports. The firm has not received any compensation from NetScout Systems (NTCT) in the past 12 months.

The analyst, a member of the analyst’s household, and/or an account in which the analyst exercises discretion hold(s) a long position in the common stock of NetScout Systems (NTCT).